Interactive Analysis

data

data

data

data

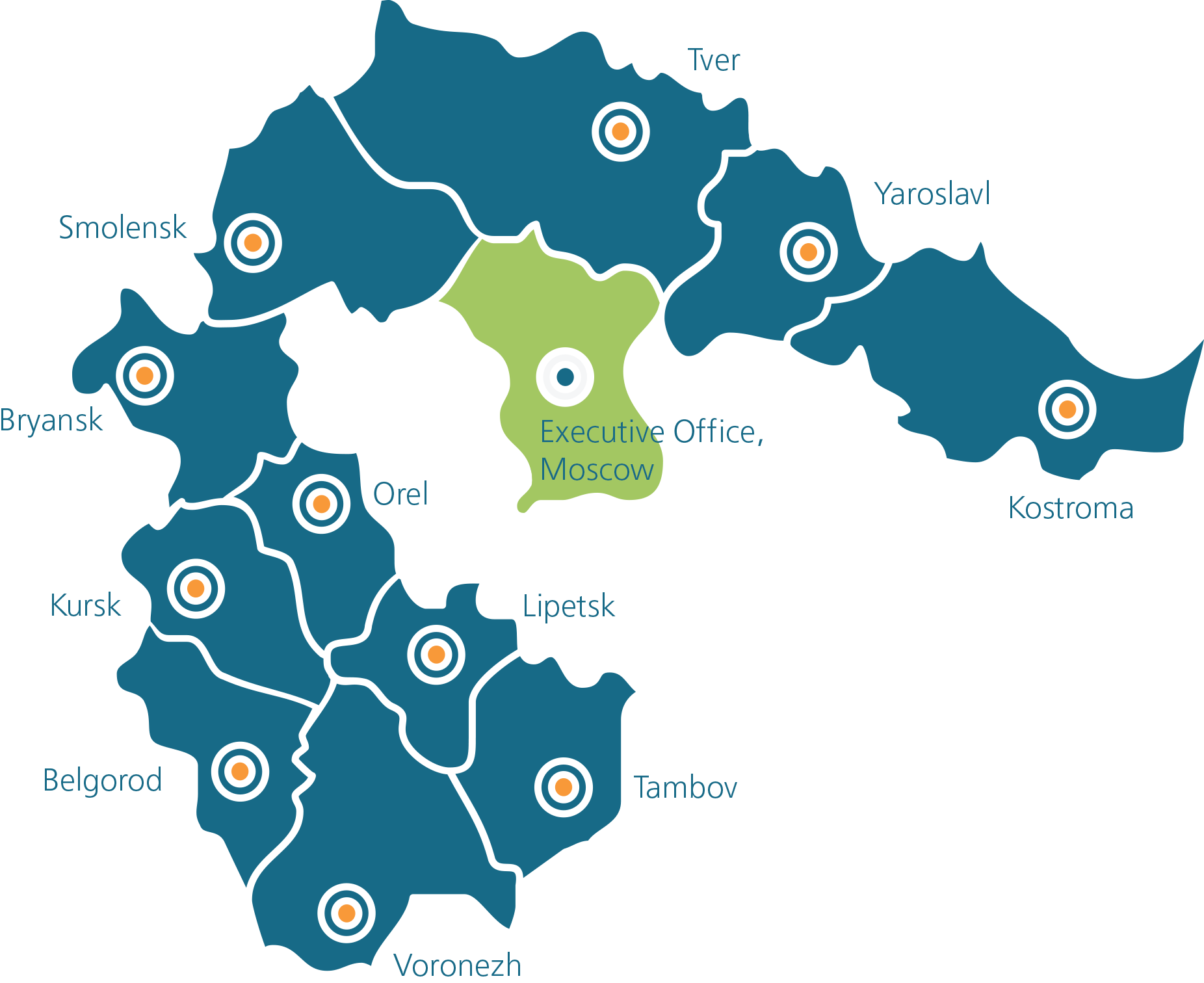

Overview

Service area

Population

KEY INDICATORS

THE GEOGRAPHY OF ACTIVITY(1)

TYPES OF OPERATIONSMarket Cap, USD mln

Productive supply(2), bn kWh

Revenue (RAS/IFRS), RUB bn.

Net income (RAS/IFRS)(3), RUB bn

CAPEX, RUB bn

Staff (RAS/IFRS), thousand people

Number of shareholders(4)

Market Cap, USD mln

Productive supply(2), bn kWh

Revenue (RAS/IFRS), RUB bn

Net income (RAS/IFRS)(3), RUB bn

CAPEX, RUB bn

Staff (RAS/IFRS), thousand people

Number of shareholders(4)

Market Cap, USD mln

Productive supply(2), bn kWh

Revenue (RAS), RUB bn

EBITDA(3) (RAS), RUB bn

CAPEX, RUB bn

Staff (RAS/IFRS), thousand people

Number of shareholders(4)

808

57.9

69.4/69.9

3.5/4.4

15.8

29.9/31.2

16,428

475

29

41.8/41.9

1.2/0.6

4.2

30.8/31.5

16,428

342.6

42.4

64.59

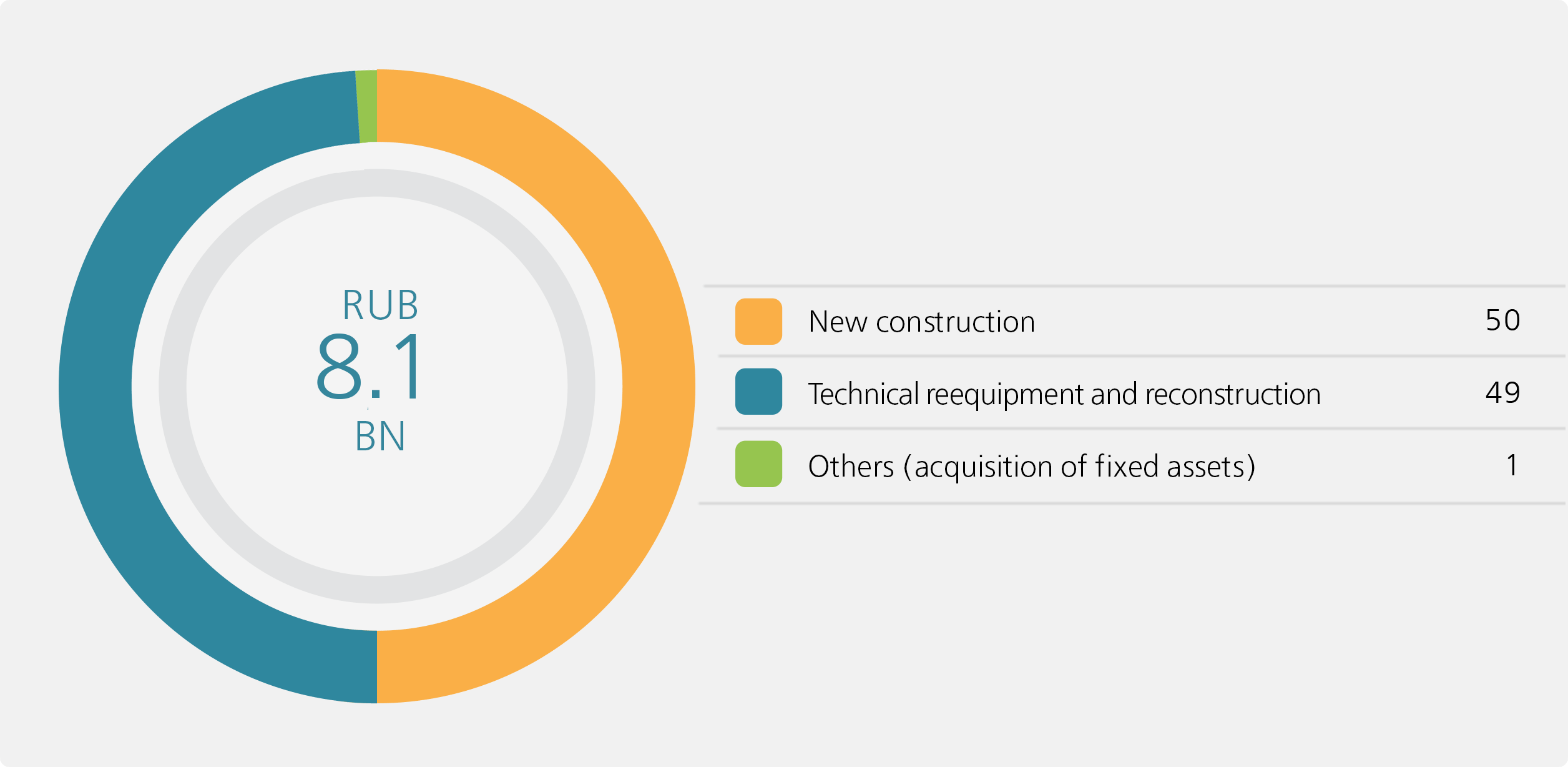

8.1

8.1

30.8

16,428

• Transmission and distribution of power electricity

• Grid connection

• Energy services

• The functions of a supplier of last resort

(from 01.02.2013 Bryansk, Kursk, Orel,

from 01.05.2013 Tver, from 01.10.2013 Smolensk).

IDGC of Centre is a natural monopoly; prices are set by regulators: the Federal Tariff Service (FTS) and regional regulatory bodies (REC)

| Area of the region | 60.2 thousand sq. km |

|---|---|

| Population | 668 thousand people |

| Share in the power transmission market (in terms of revenue) |

97.0% |

| Share in the market for grid connection | 100% |

| Length of 0.4-110 kV overhead lines (along the ROW) |

23,775 km |

| Length of 0.4-110 kV cables | 1,474 km |

| Capacity of Substations | 3,166 MVA |

| Number of substations | 6,438 |

| Number of installed units | 105,162 |

| Area of the region | 36.2 thousand sq. km |

|---|---|

| Population | 1,272 thousand people |

| Share in the power transmission market (in terms of revenue) |

78.4% |

| Share in the market for grid connection | 90% |

| Length of 0.4-110 kV overhead lines (along the ROW) |

26,606 km |

| Length of 0.4-110 kV cables | 317 km |

| Capacity of Substations | 4,111 MVA |

| Number of substations | 7,020 |

| Number of installed units | 124,458 |

| Area of the region | 84.2 thousand sq. km |

|---|---|

| Population | 1,353 thousand people |

| Share in the power transmission market (in terms of revenue) |

77.3% |

| Share in the market for grid connection | 89.1% |

| Length of 0.4-110 kV overhead lines (along the ROW) |

46,315 km |

| Length of 0.4-110 kV cables | 317 km |

| Capacity of Substations | 5,612 MVA |

| Number of substations | 11,432 |

| Number of installed units | 170,828 |

| Area of the region | 49.8 thousand sq. km |

|---|---|

| Population | 986 thousand people |

| Share in the power transmission market (in terms of revenue) |

93.9% |

| Share in the market for grid connection | 99% |

| Length of 0.4-110 kV overhead lines (along the ROW) |

38,053 km |

| Length of 0.4-110 kV cables | 2,016 km |

| Capacity of Substations | 4 822 MVA |

| Number of substations | 9,392 |

| Number of installed units | 155,094 |

| Area of the region | 34.9 thousand sq. km |

|---|---|

| Population | 1,278 thousand people |

| Share in the power transmission market (in terms of revenue) |

71.3% |

| Share in the market for grid connection | 77% |

| Length of 0.4-110 kV overhead lines (along the ROW) |

25,078 km |

| Length of 0.4-110 kV cables | 131 km |

| Capacity of Substations | 3,060 MVA |

| Number of substations | 5,783 |

| Number of installed units | 84,323 |

| Area of the region | 24.7 thousand sq. km |

|---|---|

| Population | 787 thousand people |

| Share in the power transmission market (in terms of revenue) |

84.0% |

| Share in the market for grid connection | 90.1% |

| Length of 0.4-110 kV overhead lines (along the ROW) |

27,866 km |

| Length of 0.4-110 kV cables | 117 km |

| Capacity of Substations | 2,552 MVA |

| Number of substations | 5,986 |

| Number of installed units | 92,099 |

| Area of the region | 30.0 thousand sq. km |

|---|---|

| Population | 1,127 thousand people |

| Share in the power transmission market (in terms of revenue) |

80.5% |

| Share in the market for grid connection | 78.3% |

| Length of 0.4-110 kV overhead lines (along the ROW) |

34,734 km |

| Length of 0.4-110 kV cables | 240 km |

| Capacity of Substations | 4,950 MVA |

| Number of substations | 9,462 |

| Number of installed units | 152,255 |

| Area of the region | 27.1 thousand sq. km |

|---|---|

| Population | 1,533 thousand people |

| Share in the power transmission market (in terms of revenue) |

98.7% |

| Share in the market for grid connection | 100% |

| Length of 0.4-110 kV overhead lines (along the ROW) |

41,679 km |

| Length of 0.4-110 kV cables | 6,346 km |

| Capacity of Substations | 7,108 MVA |

| Number of substations | 12,454 |

| Number of installed units | 275,343 |

| Area of the region | 24.0 thousand sq. km |

|---|---|

| Population | 1,174 thousand people |

| Share in the power transmission market (in terms of revenue) |

81.1% |

| Share in the market for grid connection | 82.5% |

| Length of 0.4-110 kV overhead lines (along the ROW) |

28,153 km |

| Length of 0.4-110 kV cables | 349 km |

| Capacity of Substations | 4,085 MVA |

| Number of substations | 7,630 |

| Number of installed units | 112,969 |

| Area of the region | 52.2 thousand sq. km |

|---|---|

| Population | 2,335 thousand people |

| Share in the power transmission market (in terms of revenue) |

77.1% |

| Share in the market for grid connection | 77% |

| Length of 0.4-110 kV overhead lines (along the ROW) |

51,022 km |

| Length of 0.4-110 kV cables | 188 km |

| Capacity of Substations | 6,361 MVA |

| Number of substations | 11,584 |

| Number of installed units | 176,752 |

| Area of the region | 34.5 thousand sq. km |

|---|---|

| Population | 1,092 thousand people |

| Share in the power transmission market (in terms of revenue) |

71.3% |

| Share in the market for grid connection | 76% |

| Length of 0.4-110 kV overhead lines (along the ROW) |

26,500 km |

| Length of 0.4-110 kV cables | 116 km |

| Capacity of Substations | 3,499 MVA |

| Number of substations | 6,167 |

| Number of installed units | 100,209 |

| Area of the region | 457.8 thousand sq. km |

|---|---|

| Population | 13.6 mln people |

| Share in the power transmission market (in terms of revenue) |

83.6% |

| Share in the market for grid connection | 87% |

| Length of 0.4-110 kV overhead lines (along the ROW) |

369,780 km |

| Length of 0.4-110 kV cables | 11,612 km |

| Capacity of Substations | 49,326 MVA |

| Number of substations | 93,348 |

| Number of installed units | 1,549,492 |

Strategic Goals of IDGC of Centre

RELIABILITY

AND INNOVATION

• Reducing technological and commercial losses (implementation of smart metering systems)

• Adopting asset management methods (technical risk management)

• Implementing a system for calculating SAIDI (System Average Interruption Duration Index) (1)/ SAIFI

(System Average Interruption Frequency Index) (2) in accordance with international standards

SHARE

• Increasing the market share in operating regions

• Consolidating grid assets (TGO, abandoned grids)

ACTIVITY

• Using standards designs

• Increasing the efficiency of procurement

• Improving control over the work of contractors

• Increasing the efficiency of management: implementing an optimal KPI system for senior management

• Optimizing systems and processes for operations and repairs

• Developing additional types of energy services

APPEAL

• Implementation of stable dividend payments policy

• Taking measures for improving the liquidity of shares

• Entering foreign stock markets

Key Performance Indicators for 2012

Net income

Net income

covered with

cash flow

Target

2.9RUB bn

Actual

3.0RUB bn

Equity

Target

50.5RUB bn

Actual

50.5RUB bn

ROE

covered with

cash flow

Electrical energy losses

to supply to the grid

Target

9.93%

Actual

9.71%

Number of

accidents

Target

0

Actual

0

System Average

Interruption Frequency

Index (SAIFI)

Target

< 1

Actual

0.99

System Average

Interruption Duration

Index (SAIDI)

Target

< 1

Actual

0.9

Investment program

implementation efficiency

in the current year

Target

≥ 95

Actual

103

The KPI implementation plan for 2012 was approved by the resolution of the Board of Directors of IDGC of Centre, minutes No. 28/11 of December 30, 2011; minutes No. 22/12 of September 21, 2012. Actual KPI implementation for 2012 was approved by the Board of Directors of IDGC of Centre, minutes No. 13/13 of May 30, 2013

Business Model of IDGC of Centre

Electricity is transmitted from generating companies to the area of responsibility of IDGC of Centre, the “joint operation” area (IDGC of Centre + TGC): either directly or via FGS UES

Electricity is transmitted from the area of responsibility of IDGC of Centre (from the “joint operation” area) to consumers (under “direct” contracts + power supply contracts): either directly or via TGC

Part 1:

- Consumers make payments for electricity under sale and purchase agreements to power supply companies and guarantee suppliers

- Consumers make payments for electricity and power transmission under power supply contracts to power supply companies and guarantee suppliers

- IDGC of Centre and TGC make payments for energy losses under sale and purchase agreements to power supply companies and guarantee suppliers

Part 2:

- Payment for electricity from power supply companies and guarantee suppliers to the wholesale electricity market

- Payment for electricity from consumers to the wholesale electricity market

Part 3:

- Power supply companies and guarantee suppliers make payments for power transmission under contracts for power transmission to IDGC of Centre

- Consumers make payments for power transmission under contracts for power transmission to IDGC of Centre

Part 4:

- IDGC of Centre makes payments for power transmission under contracts for power transmission to FGC UES

- IDGC of Centre makes payments for power transmission under contracts for power transmission to TGC

(LETTERS IN BLUE TRIANGLES)

Part 1:

- Consumers make payments for electricity under sale and purchase agreements to power supply companies, guarantee suppliers and IDGC of Centre

- Consumers make payments for electricity and electricity transmission under power supply contracts to power supply companies, guarantee suppliers and IDGC of Centre

- TGC make payments for energy losses under sale and purchase agreements to power supply companies, guarantee suppliers and IDGC of Centre

Part 2:

- Payment for electricity from power supply companies, guarantee suppliers and IDGC of Centre to the wholesale electricity market

- Payment for electricity from consumers to the wholesale electricity market

Part 3:

- Power supply companies and guarantee suppliers make payments for power transmission under contracts for power transmission to IDGC of Centre

- Consumers make payments for power transmission under contracts for power transmission to IDGC of Centre

Part 4:

- IDGC of Centre makes payments for power transmission under contracts for power transmission to FGC UES

- IDGC of Centre makes payments for power transmission under contracts for power transmission to TGC

Electricity transmission market share(1), %

Tariff Regulation

Forecast of boiler NGP and the growth rate of unified boiler tariff

for electricity transmission services subject to any adjustments*

AVERAGE ONE-RATE TARIFF,

Kopecks/kWh

Approved parameters of tariff regulation

Rate of return on the "new" capital in 2012 - 12%, in 2017 - 11%

| IRAB, RUR bln | Operating expenses | Rate of return on the "old" capital,% | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Basic level, RUR mln. | Performance Index, % | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | ||

| Belgorodenergo | 17,730 | 2,694 | 3% | 12% | 11% | 11% | 11% | 11% | 11% |

| Bryanskenergo | 1,056 | 1% | |||||||

| Voronezhenergo | 12,554 | 1,685 | 3% | 1% | 1% | 1% | 1% | 1% | 11% |

| Kostromaenergo | 6,187 | 947 | 3% | 3% | 3% | 3% | 4% | 6% | 11% |

| Kurskenergo | 6,384 | 852 | 2% | 1% | 1% | 1% | 1% | 1% | 11% |

| Lipetskenergo* | 1,208 | 5%/2% | |||||||

| Orelenergo | 4,207 | 877 | 3% | 1% | 1% | 1% | 1% | 1% | 11% |

| Smolenskenergo | 7,658 | 1,623 | 3% | 3% | 5% | 10% | 11% | 11% | 11% |

| Tambovenergo | 3,245 | 925 | 3% | 1% | 1% | 1% | 5% | 11% | 11% |

| Tverenergo* | 1,836 | 1% | |||||||

| Yarenergo | 8,579 | 1,116 | 1% | 1% | 2% | 2% | 3% | 4% | 11% |

* Tverenergo, Lipetskenergo with regard to the revision of PP number 953 by 24.10.2013

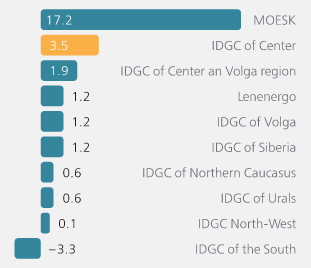

Comparative analysis with the Peers

IDGC of Centre is an industry leader in terms of key operating, financial and economic indicators

#1

in terms of length of power lines

Length of power lines (9M 2013),

thousand km

381.4

255.1

242.8

215.8

175.1

157.6

139.0

120.2

113.1

57.3

#2

in terms of capitalization

Market Cap (9M 2013),

RUB bn

57.5

11.1

9.6

7.6

7.4

5.7

4.8

3.3

1.7

1.0

#2

in terms of trading volume

Trading volume(1) (9M 2013), RUB mln

915.4

622.0

502.4

343.4

188.9

170.5

128.1

108.2

77.7

41.0

#2

in terms of revenue

Revenue (under RAS) (9M 2013), RUB bn

88.3

64.5

55.2

44.0

40.2

35.1

29.1

24.3

19.9

8.3

#2

in terms of dividends

Dividends for 2012, RUB mln

4,296.0

862.9

479.0

308.6

291.1

289.2

160.3

156.5

15.4

0.0

Characteristics of Grid Assets

IDGC of Centre has one of the largest power grids among other IDGCs

Length of 0.4-110 kV overhead lines

(along the ROW), thousand km

Length of 0.4-110 kV cables,

thousand km

Amount of conventional units, mln

Substation capacity, thousand MVA

Number of substations, thousand units

Key Performance Indicators

Electricity output,

bln kWh

Electricity supply(1),

bln kWh

Total losses,bln kWh

Total losses,%

IDGC of Centre as a supplier of last resort

The increase in revenue due to performance the functions of supplier of last resort for 9 months of 2013 amounted to RUR 9.4 bln. (excluding VAT), which represents 14.6% of total revenue of "IDGC of Centre". Net income from the sale of electricity on the wholesale and retail markets amounted to RUR 194 mln.

Consumer debt to ESCs that lost the guarantee supplier status on 1st February 2013 has decreased by 0,9 billion rubles or 34% for the period from February to September 2013

Reduction of electricity losses in the networks of JSC "IDGC of Centre" (including effect of guarantee supplier functions performance) achieved 0.41% for 9 months of 2013 relative to comparable conditions of the

previous year.

Revenue from power sales(1) for 9M 2013 (net of VAT), RUB bn

In accordance with orders of the Ministry of Energy of Russia Nos. 25, 26 and 28 dated January 24, 2013, on February 1, 2013 IDGC of Centre was granted the status of a guarantee supplier in the operating regions of JSC Bryanskenergosbyt, JSC Kurskregionenergosbyt, JSC Orelenergosbyt. It also became a guarantee supplier in the operating regions of JSC Tverenergosbyt (on May 1, 2013 in accordance with order No. 210 dated April 25, 2013) and JSC Smolenskenergosbyt (on October 1, 2013 in accordance with order No. 646 dated September 25, 2013).

The status of a guarantee supplier acquired by the Company enabled it:

• to improve payment performance in the retail and wholesale energy market;

• to ensure transparency of payments and provide reliable power supply to socially and strategically important facilities;

• to improve the quality of customer service by creating “one-stop shop” service centres where a customer will be able to settle all issues related to power supply to consumers.

Grid Connections

Number of requests for grid connections,

thous. units

Number of contracts signed for grid connections,

thous. units

Number of implemented contracts for grid connections,

thous. units

Connected capacity,MW

Revenue from grid connections

Energy Services (Additional Services)

Maintenance and development of outdoor lighting networks

Service and repairs of power grids and electrical equipment

Overhaul of power grids for the benefit of customers

Equipment testing and diagnostics

Installation and replacement of meters

Energy audit and services

Design and construction of power generation facilities, etc.

Changes in the number of customer requests for additional

services in 2010-2012, thous. units

Company revenue from other

operations in 2010-2013(1), RUB mln

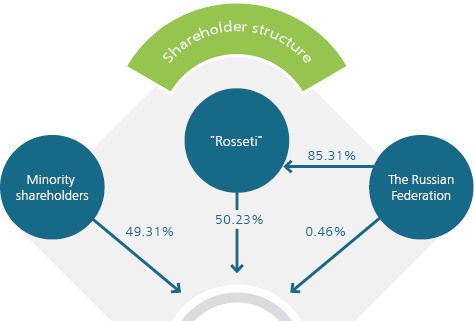

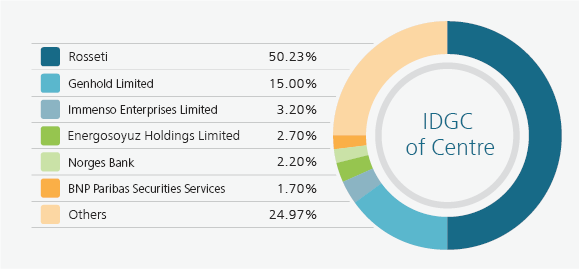

Governance Structure and Major Shareholders

25% of the company’s shares are in free float*, which is one of the highest rates in distribution sector.

Corporate Governance

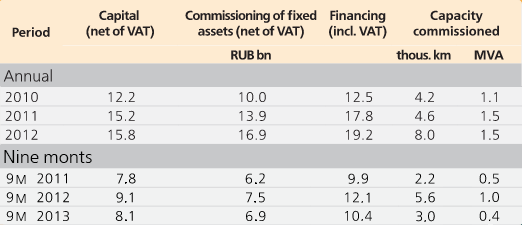

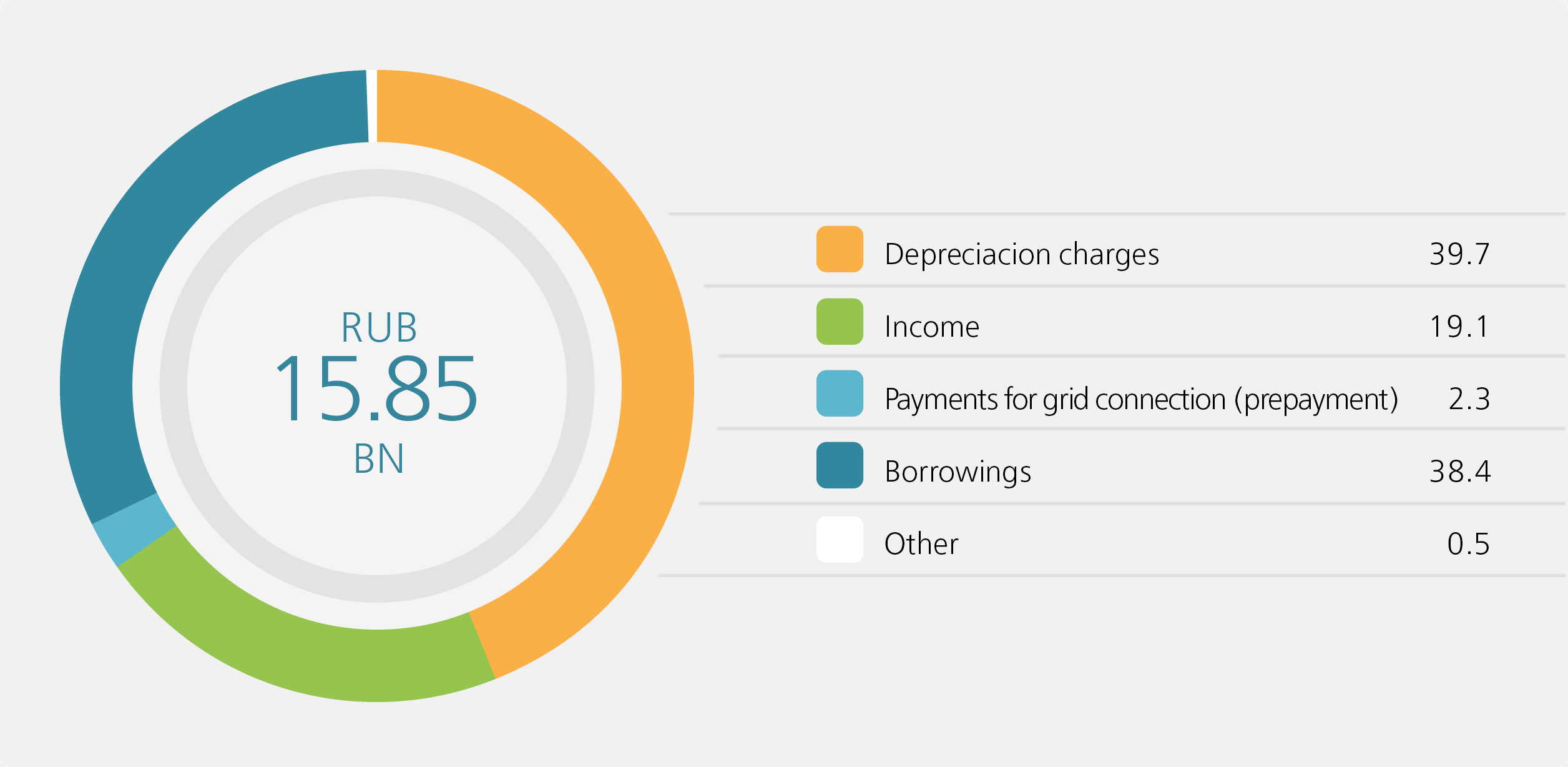

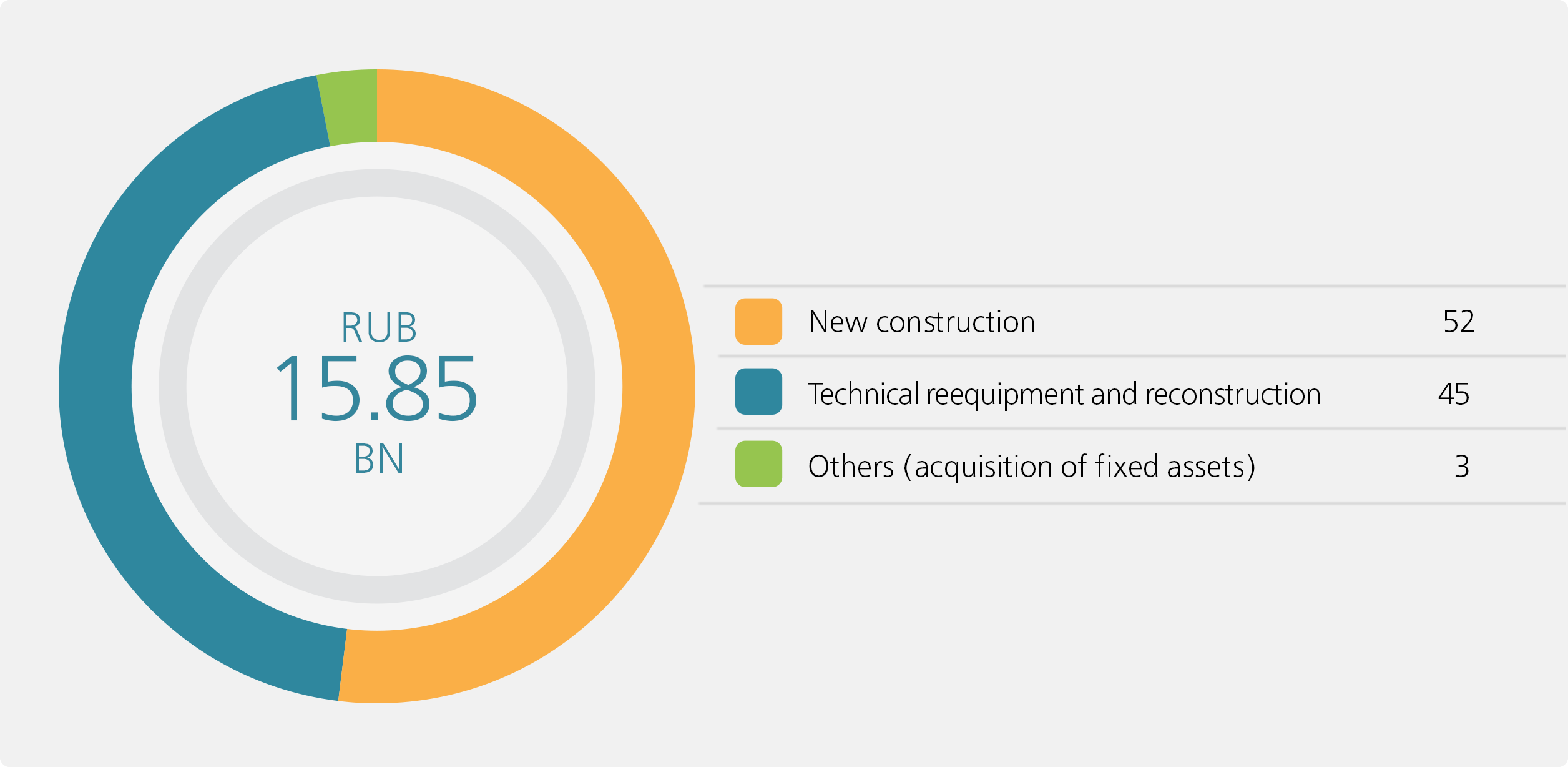

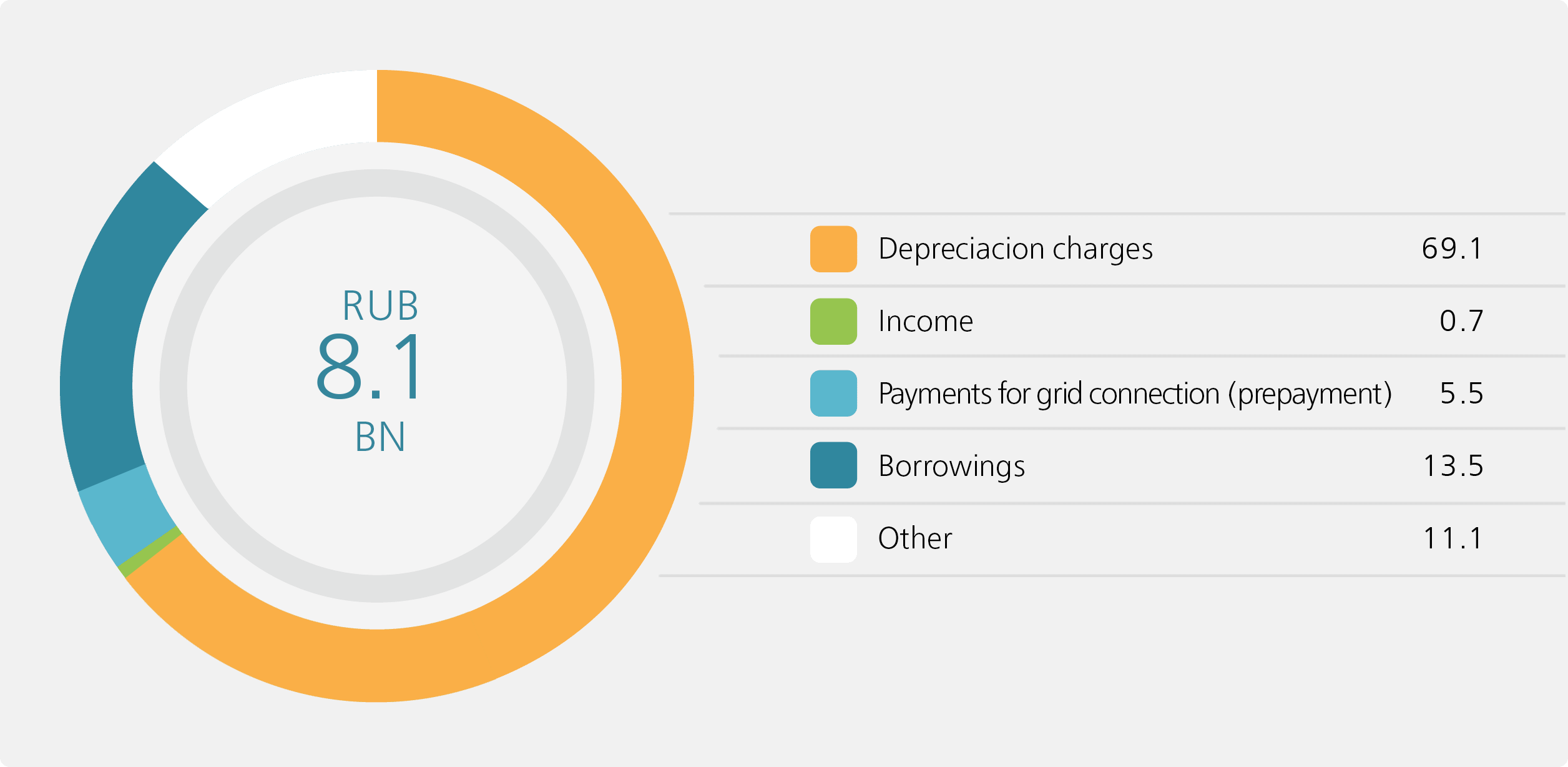

Investment Structure and Changes in Capital

Centre totalled

15.85

RUB bn

SOURCES OF FINANCE FOR CAPITAL, %

of the

Company’s

CAPEX CAPEX

breakdown

by

branch

Large Investment Projects Implemented in 2013

of investment

projects will

enable the Company

to improve reliability

and quality of power

supply in its service area

Overhaul of Motordetal – Kostroma-1 and Zavolzhskaya 1, 2 110 kV overhead lines

Project outcome: improving the reliability of power supply to consumers in Kostroma

| Commissioning: | 2014 |

|---|---|

| Estimated cost: | RUB 505 mln |

| Capacity to be commissioned: | 20 km |

Construction of a 110 kV cable line between substation No. 30 and Studencheskaya substation (No. 13)

Project outcome: improving the reliability and quality of power supply to consumers in Voronezh

| Commissioning: | 2013 |

|---|---|

| Estimated cost: | RUB 300 mln |

| Capacity to be commissioned: | 7 km |

Construction of 8 March – Korenevo – Rylsk 110 kV overhead lines

Project outcome: improving the reliability of power supply in the south-western part of the Kursk Region, which is connected with Ukraine via 110 kV transit lines

| Commissioning: | 2019 |

|---|---|

| Estimated cost: | RUB 614 mln |

| Capacity to be commissioned: | 45 km |

Overhaul of Mtsensk – Chern, Mtsensk – Plavsk 110 kV overhead lines

Project outcome: Plavsk – Mtsensk and Mtsensk – Chern 110 kV overhead lines are intersystem transit lines transmitting power from the Tula power system to the Orel Region. The project is aimed at ensuring the reliability of power transmission and increasing the capacity of the power lines

| Commissioning: | 2015 |

|---|---|

| Estimated cost: | RUB 300 mln |

| Capacity to be commissioned: | 52 km |

Renovation of Yuzhnaya 110/10 kV substation and installation of 2х40 and 2х25 MVA power transformers

Project outcome: overcoming the shortage of capacity at the regional main substation; extending the operational life of main equipment, meeting the target for quality and reliability of power supply to consumers

| Commissioning: | 2016 |

|---|---|

| Estimated cost: | RUB 541 mln |

| Capacity to be commissioned: | 130 MVA |

Construction of Kreyda 110kV substation

Project outcome: commissioning capacities to supply power to a new private housing estate; ensuring sustainability of a section of the power grid (renovation of Belgorod 330 kV substation), meeting the target for reliability of power supply; boosting power consumption

| Commissioning: | 2014 |

|---|---|

| Estimated cost: | RUB 284 mln |

| Capacity to be commissioned: | 50 MVA |

Credit Ratings and Loan Portfolio

(AS OF 30.09.2013)

outlook ‘Stable’

high reliability, a stable financial position, a high level of liquidity

| Foreign Peers | S&P | Moody's |

| National Grid (UK) | A- | — |

| Red Electrica (Spain) | BBB | Baa2 |

| REN (Portugal) | BB+ | Ba1 |

| Tata Power (India) | BB- | B1 |

| Capex SA (Argentina) | B- | — |

| Manila Electric (Philippines) |

B- | — |

| Domestic Peers | S&P | Moody's |

| FSK EES | BBB | Baa3 |

| Rosseti | — | Ba1 |

| Rushydro | BB+ | Ba1 |

| Mosenergo | BB | — |

| IDGC of Centre | BB | — |

| MOESK | BB | Ba2 |

| IDGC of Centre and Volga Region |

BB | Ba2 |

| IDGC of Volga | — | Ba2 |

| IDGC of Urals | — | Ba2 |

| Lenenergo | — | Ba2 |

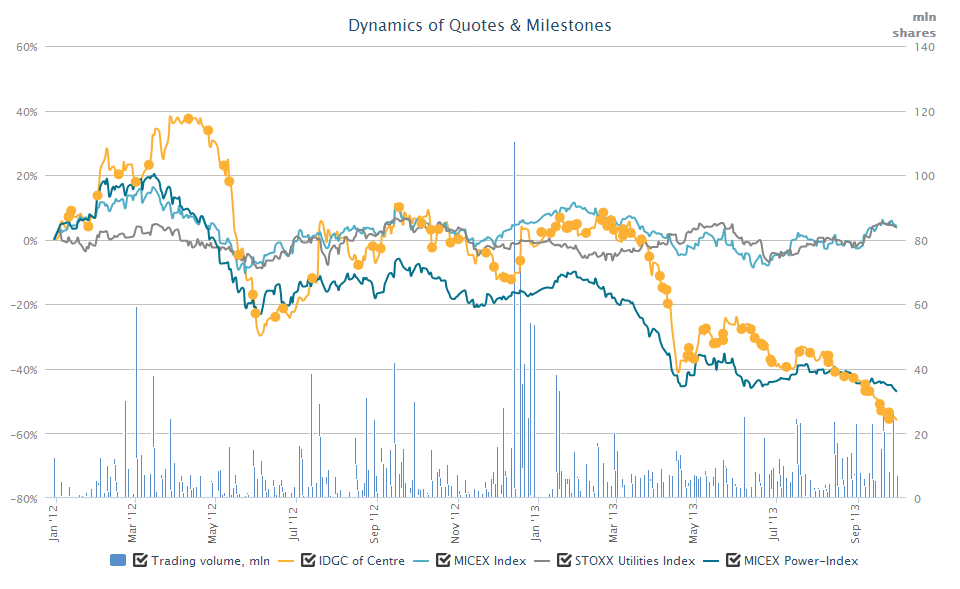

Dynamics of Quotes & Milestones

In October 2012, shares of IDGC of Centre were included in the A1 Quotation List of the MICEX Stock Exchange

Increase in regulatory risks and the lack of clear plans on tackling critical issues in electric grid complex led to a sharp drop in the value of shares of all networking companies. The Company's management believes that the growth factors of shareholder value will be the effectiveness of the program to optimize operating costs, work on consolidating assets in the operating regions, as well as the prospect of additional revenue from providing of energy services and guaranteeing supplier functions performance.

| May 21, 2008 |

| MICEX Stock Exchange | A-1 |

| Moscow Exchange | MRKC |

| Bloomberg | MRKC RX |

| Reuters | MRKC.MM |

| Weighting, % | ||

| Shares used in the index calculation | MICEX PWR | 1.85 |

| MICEX SC | 2.23 |

Investment Highlights

Operation in 11 regions of Central Russia

with strong prospects for economic growth

National Corporate Governance Rating 7+,

the highest corporate governance rating

among peer companies

Innovation leader in the sector

S&P credit rating ‘BB’, outlook ‘Stable’

Stable financial position

Development of additional energy services

Approved dividend policy

and positive dividend history

Additional revenue from performing

the functions of a supplier of last resort

Contents

limitation of liability

This presentation does not constitute an offer or solicitation of an offer ( advertising) to purchase or subscribe for securities IDGC of Center . Neither the presentation nor any part of it nor the fact of its presentation or distribution form the basis for any contract or investment decision , and the presentation should not rely in this regard. This presentation includes forward-looking statements . Forward-looking statements are not based on factual circumstances , and include statements regarding the intentions, beliefs or current expectations of IDGC of Centre, regarding the results of its operations, financial condition , liquidity, prospects , growth, strategies and the industry in which the Company operates . By their nature, such forward-looking statements involve risks and uncertainties because they relate to events and depend on circumstances that may not happen in the future . The Company cautions that forward-looking statements are not guarantees of future performance and actual results of operations , financial condition and liquidity and the development of the industry in which it operates may differ materially from those presented in the forward- statements contained in this document. Furthermore, even if the results of operations , financial condition and liquidity and the development of the industry in which it operates are consistent with the forward -looking statements contained in this document , these results and developments may not be indicative of results or developments in future. In addition to the official information on the activities of IDGC of Centre , in this presentation contains information received from third parties. This information has been obtained from sources that are believed IDGC of Center , are reliable . Nevertheless , we can not guarantee the accuracy of this information , which may be condensed or incomplete. All opinions and estimates contained herein reflect our opinion of the publication date and are subject to change without notice. IDGC of Centre is not responsible for the consequences of use contained in this presentation opinions or statements or incomplete information . IDGC of Center does not undertake any obligation to review or confirm forward-looking statements and estimates , as well as to update the information contained in the presentation. Despite the fact that up to 31.03.2008, IDGC of Center was operating company , this presentation contains consolidated data for all areas of responsibility RSK IDGC of Centre , including for the period ending 31/03/2008 . Information on financial and production data obtained on the Company , as the sum of 11 indicators RSK acceding to IDGC of Centre. Despite the fact that in 2006 and 2007 under the control of IDGC of Centre ( while IDGC of Centre and North Caucasus ) were more than 11 companies , for correct comparison information for these periods is given by 11 DGC current configuration.